AI Broker

AI-Powered Multi-Agent Trading Platform

Democratizing institutional-grade algorithmic trading through specialized AI agents,

bridging equities and prediction markets for retail and institutional investors

bridging equities and prediction markets for retail and institutional investors

$13.5B AI Trading Market → $70B by 2034

The Problem

⚠️

Lack of Institutional Tools

Retail traders miss complex market signals, macro indicators, and sharp money movements

📊

Prediction Market Complexity

$10B+ monthly volume, yet most traders can't extract actionable intelligence at scale

🔍

Information Overload

Sentiment shifts, insider transactions, and technical signals require 24/7 monitoring

💸

High Barrier to Entry

Algorithmic trading infrastructure is expensive and requires deep technical expertise

Our Solution

Multi-Agent AI System

Specialized AI agents work collaboratively to analyze markets, debate strategies, and execute trades with institutional-grade precision

🤖

Analyst Team: Fundamentals, Sentiment, News, Technical

💬

Researcher Team: Bull vs. Bear structured debate

⚡

Trader Agent: Entry/exit timing + position sizing

🛡️

Risk Manager: Volatility, liquidity, correlation analysis

✅

Portfolio Manager: Final approval layer

Bridges Equities + Prediction Markets

Polymarket, Kalshi, Traditional Exchanges

Market Opportunity

$13.5B → $70B

AI Trading Platform Market

20% CAGR from 2025 to 2034

$21B → $43B

Algorithmic Trading Market

Growing at 8-10% annually through 2030

$10B+

Prediction Markets Monthly Volume

Polymarket + Kalshi combined (Nov 2025)

Regulatory Tailwind

Kalshi $11B valuation, $1B raise

Institutional adoption accelerating

CFTC-regulated exchanges emerging

Institutional adoption accelerating

CFTC-regulated exchanges emerging

Product Overview

🎯

Multi-Agent Analysis

Analyst + Researcher teams debate insights, Trader agent executes with precision

⚡

4-6 Algorithmic Strategies

Momentum, Mean Reversion, Breakout, Scalping, Prediction Market Arbitrage

📊

Real-Time Signal Scoring

Weighted scoring: 30% technical, 20% VIX, 15% PE, 20% sentiment, 15% insider

🔗

Prediction Market Integration

Track sharp traders on Polymarket/Kalshi, copy trades, exploit mispricings

🛡️

Institutional Risk Management

Dynamic position sizing, stop losses, portfolio correlation, stress testing

24/7 Automated Trading • Real-Time Alerts • Copy Trading

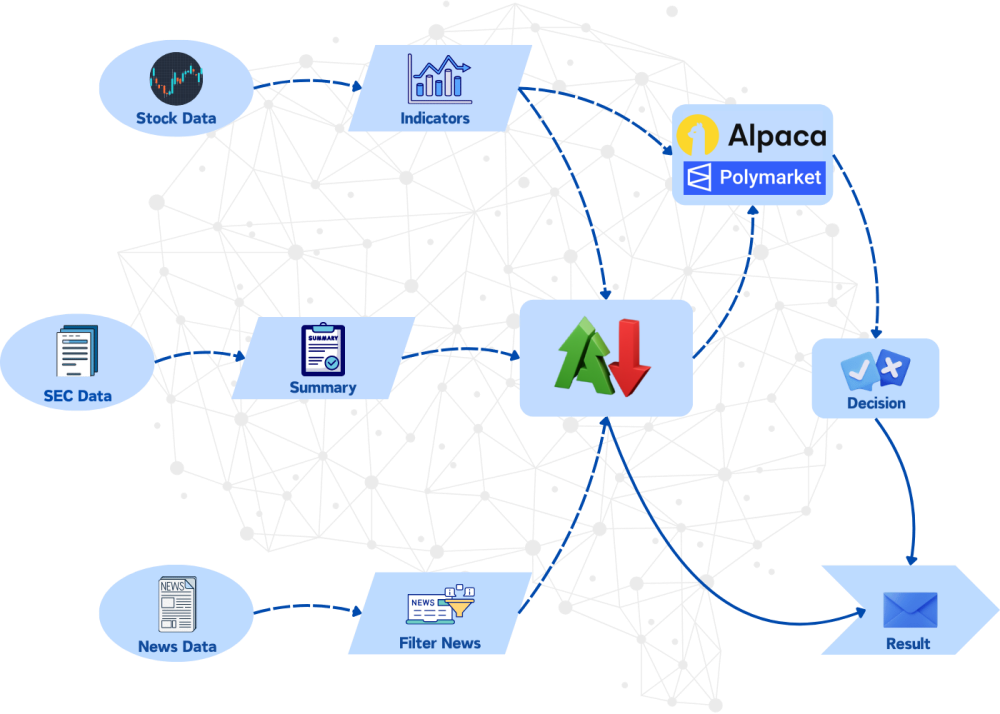

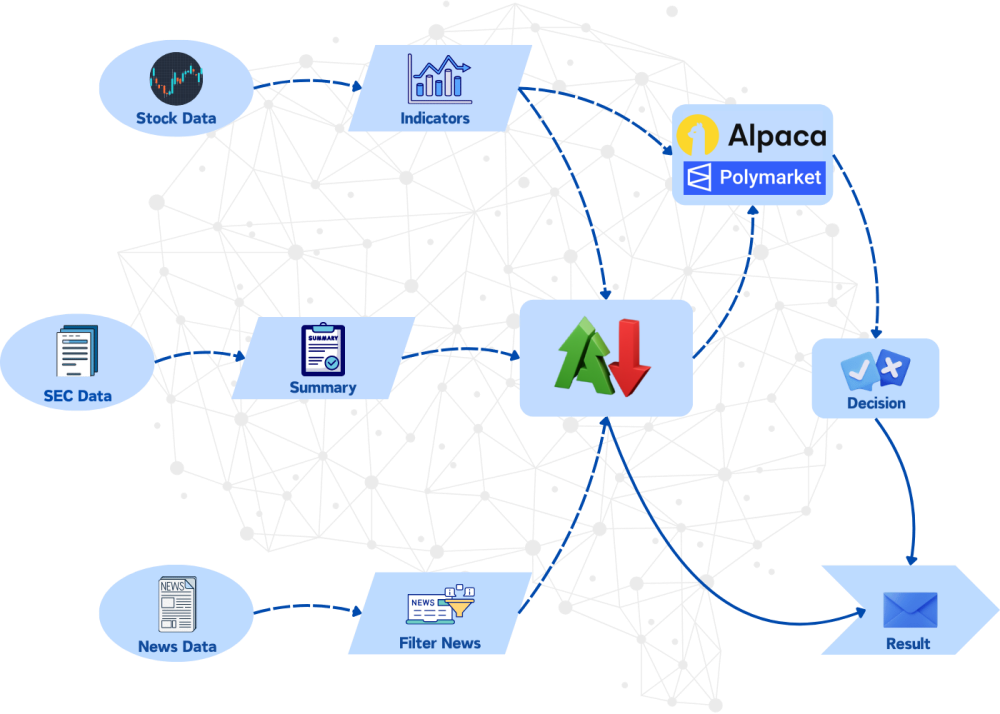

Multi-Agent Architecture

📊

Analyst Team

Fundamentals, Sentiment, News, Technical agents gather parallel data streams

💬

Researcher Team

Bull vs. Bear agents debate insights using structured frameworks

⚡

Trader Agent

Synthesizes debate output, determines entry/exit timing + position size

🛡️

Risk Manager

Evaluates volatility, liquidity, portfolio correlation before execution

✅

Portfolio Manager

Final approval layer with veto power on all transactions

Hierarchical Orchestration

Centralized coordinator delegates tasks to specialized agents with domain-specific tools and memory

Algorithmic Strategies

Momentum Trading

50-60%

Capitalizes on trending markets by following price movements and volume surges

Best for: Trending markets, breakout scenarios

Mean Reversion

55-65%

Identifies overbought/oversold conditions and trades expected price corrections

Best for: Range-bound markets, volatile oscillations

Breakout Trading

45-55%

Captures explosive moves when price breaks through key resistance/support levels

Best for: High volume rallies, news-driven events

Scalping / Day Trading

60-70%

Exploits small intraday price movements with rapid entry/exit execution

Best for: High liquidity, tight spreads

Prediction Market Arbitrage

Variable

Exploits mispricings between prediction markets and traditional exchanges

Best for: Event-driven opportunities, sharp trader tracking

Prediction Market Integration

🔗

Direct Integration

Seamlessly connect with Polymarket and Kalshi APIs for real-time order execution and data ingestion

🐋

"Sharp Trader" Tracking

Monitor wallet addresses of historically profitable whales and public figures (e.g., senators, CEOs)

🤖

LLM Arbitrage Analysis

Agents analyze news events vs. prediction probabilities to find +EV setups missed by the crowd

Risk Management Engine

Dynamic Position Sizing

Kelley Criterion integrated with volatility scaling to optimize bet sizes

Automated Stop-Losses

Trailing stops and hard stops executed at the exchange level

Black Swan Protection

Portfolio de-risking during extreme VIX spikes or macro events

Correlation Matrix

Prevents over-exposure to single sectors or related assets

Platform Architecture

📡

Data Ingestion Layer

Real-time websockets (Alpha Vantage, Polygon.io) + News APIs + On-chain listeners

🤖

Multi-Agent Processing

LLM-powered analysis, structured debate, signal generation, outcome prediction

⚡

Execution Engine

Low-latency order routing, broker integrations, copy-trading mechanics

🛡️

Risk & Compliance

Real-time monitoring, portfolio management, regulatory compliance checks

📱

User Interface

Web + mobile dashboards, real-time alerts, customizable views

Technology Stack

Python

Node.js

React

AWS/GCP

LLMs

WebSockets

Competitive Advantage

AI Broker

✓ Multi-Agent AI

✓ Prediction Markets

✓ 4-6 Strategies

✓ LLM Research

✓ Copy Trading

✓ Institutional Risk

Trade Ideas

✓ AI Signals

✗ Equities Only

✓ Technical Focus

✗ No Debate

✗ No Copy Trading

Basic Risk

Alpaca/IBKR

Basic Algos

✗ Broker Lock-in

Limited Strategies

✗ Minimal AI

✗ No Prediction

Standard Risk

Hedge Funds

Manual Research

High Fees (2/20)

Slow Decisions

✗ Centralized

✗ No Retail Access

✓ Strong Risk

🧠

True Multi-Agent Reasoning

Bull vs. Bear debate creates robust logic

🔗

Prediction Market Bridge

Bridging equities and event markets

🎯

Democratized Access

Institutional tools at retail prices

Business Model

💳

Subscription Tiers

Free tier (basic signals), Pro ($29-99/mo), Enterprise ($500+/mo)

📈

Performance Fees

10-25% of net gains on user accounts - aligns incentives like hedge funds

🏢

Enterprise Licensing

White-label platform for brokers, funds, fintech partners (5-6 figure annual)

👥

Copy-Trading Fees

2-5% commission on copied trades from sharp traders (Polymarket leaderboard)

🔌

API Access

B2B2C: Other platforms pay for direct access to AI Broker signals

Revenue Projections

Year 1

$750K

500 paid users

Year 2

$5.4M

3K paid users

Year 3

$27M

12K paid users

Unit Economics

CAC

$50-100

LTV

$1.5-3K

LTV:CAC

20-40x

Margin

75-80%